Prosper vs. Frisco: Which Texas Suburb Is Right for Your Next Move?

If you're planning to buy a home in the North Dallas area, chances are Prosper and Frisco are both on your radar. These fast-growing suburbs offer luxury living, excellent schools, strong home appreciation, and a lifestyle that's hard to beat.But which one is right for you?Whether you're relocating, upgrading, or buying your first home in the $500,000–$1.5 million range, this side-by-side comparison will help you make a confident decision — with financial tips, lifestyle factors, and real estate insights tailored to Texas buyers.

Prosper at a Glance

Prosper, TX is known for its spacious lots, upscale homes, and quieter, family-focused vibe. While still growing rapidly, it retains a small-town charm that appeals to buyers seeking a more relaxed pace.

Highlights:

- Larger homes on bigger lots

- High-performing Prosper ISD schools

- Quieter residential feel

- More room for custom homes, new builds, and outdoor space

- Fewer commercial developments than Frisco

Frisco at a Glance

Frisco, TX is a nationally ranked suburb that’s rapidly evolved into a major DFW hub. It offers a more urban-suburban hybrid feel, with tons of dining, retail, entertainment, and corporate headquarters.

Highlights:

- Walkability to shops, restaurants, and sports venues

- Top-rated Frisco ISD schools

- Dense residential developments and master-planned communities

- Home to The Star, PGA headquarters, and more

- Higher population density

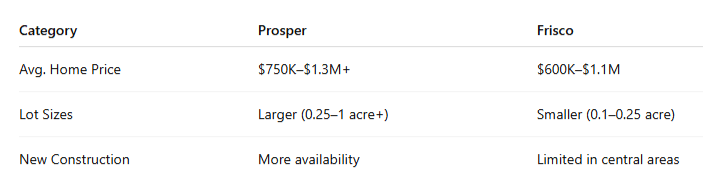

Home Prices & Appreciation

Both suburbs have seen strong appreciation in recent years, but Prosper’s homes tend to be newer and slightly more expensive per square foot — largely due to lot size and custom finishes.

School District Showdown

You can’t go wrong with Prosper ISD or Frisco ISD — both are highly rated and continually expanding.- Prosper ISD: Known for newer campuses, strong athletic programs, and community support

- Frisco ISD: Offers more schools (smaller student bodies per school), strong academic and fine arts focus

Property Taxes & HOA Fees

Both suburbs have relatively high property tax rates compared to other Texas regions — often 2.3%–2.7%. HOA fees vary widely by community but tend to be slightly higher in Frisco due to more master-planned amenities.

Smart Tech & Move-In Must-Haves

Both cities are hot relocation markets — and smart move-in upgrades are key, especially in luxury homes.Affiliate Pick: Smart Home Security System – Secure your new home on day one and control everything from your phone. Smart buyers are also installing:

- Wi-Fi locks

- Video doorbells

- Smart garage openers

- Leak detectors for slab foundations common in DFW homes

Mortgage Tip: New Builds vs. Resales

- Prosper: More new construction available, ideal for customization — but may come with higher build-time delays or costs

- Frisco: More resale inventory, meaning faster move-ins and established landscaping

So, Which Suburb Wins?

Choose Prosper if you want:- More space, privacy, and long-term growth

- A strong sense of community and newer infrastructure

- A quiet, upscale lifestyle

- Energy, entertainment, and urban convenience

- Faster commute times and more central DFW access

- Greater walkability and amenity-rich neighborhoods

Let Emmly Financial Guide Your Move

Whether you’re leaning toward Frisco or falling in love with Prosper, Emmly Financial is here to help you get pre-approved, navigate local taxes, and secure the best mortgage for your budget and goals. Contact us today for a custom loan consultation tailored to your next move in DFW.Categories

Recent Posts

Home Security Upgrades That Could Lower Your Insurance Premium

How to Save for a Down Payment Without Sacrificing Your Lifestyle

First-Time Buyer Essentials That Make Moving Day Stress-Free

The Hidden Costs of Homeownership You Should Budget for in Texas

Must-Have Tech for Busy Professionals Applying for a Mortgage in Texas

Prepping for a Home Appraisal? Here’s What to Fix Before They Arrive

Should You Rent or Buy in Today’s Market?

Budget-Friendly Security Tips for Texas Homeowners

Clean and Stage Your Home on a Budget Before You Refinance or Sell

Cut Utility Costs and Save More for Your Texas Home Purchase or Refinance